-

The MGA can offer AI liability limits up to $8.5mn for US companies.

-

Renfe has mandatory accident insurance with Everest and liability cover with QBE.

-

Fresh from a deal with QBE Re, the investment firm discusses drivers of casualty ILS growth.

-

The carrier will offer $10mn per risk, targeting large corporations.

-

Weather events and potential increases in US casualty reserves remain sources of volatility.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

The carrier’s overall P&C combined ratio improved by 1.4 points to 91.6%.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The appointments are aimed at offering a clearer team structure.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Brian Church has spent 20 years at Chubb.

-

In July, he took the role on interim basis from Laure Forgeron.

-

West Hill Capital is the main investor in the capital raise.

-

She previously served as Hub’s North American casualty practice leader.

-

Tom Potter was global casualty underwriting manager for UK & Lloyd’s at Axa XL.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The executive met with UK colleagues to discuss plans for the US business.

-

The combined casualty treaty team has also made a number of hires.

-

There will also be a renewed focus on organic growth, both in P&C and across US and international operations.

-

Her predecessor will become head of US excess casualty and operations.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He was appointed CUO of casualty, Americas, in July last year.

-

The platform aims to “bend the loss curve”.

-

The executive most recently served as head of North American treaty reinsurance.

-

Signs of discipline indicate a “break” from past boom/bust market cycles.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

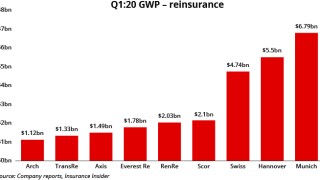

Top line grew across all carriers even as pre-tax profits dipped.

-

He joins from MS Amlin, where he was lead underwriter for US casualty.

-

The reinsurer chair said the frequency of losses today “will prevent prices from slipping too much.

-

The Swiss carrier improved its P&C combined ratio by 1.2 points to 92.4%.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The newly created role consolidates leadership across UK entities.

-

The Canadian insurer saw property rates dip across its global divisions.

-

The executive was previously head of excess casualty, North America.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The P&C segment posted an 82.5% combined ratio for the quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The legacy player is working to secure its first deal, and could look to expand to US E&S.

-

Wind season remains an important variable, but also might not change current dynamics significantly.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Property rates declined by 7% globally in the second quarter.

-

The property segment reported a CoR of 27.4% for the quarter, down 26.5 points year on year.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

Peter Cordell will join Syndicate 1729 in January.

-

Dual’s Luke Browne will join Consilium Risk Solutions.

-

Last year, the firm obtained a Class 4 license in Bermuda.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The international casualty director has worked at Axa XL, Ive and Ardonagh.

-

The LA wildfires accounted for 59% of loss activity over Q1.

-

Niala Butt joins from CNA Hardy, where she was casualty claims manager.

-

Although US pricing is improving there is pressure in other geographies.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The executive brings nearly 30 years of liability experience to the role.

-

Jim Meakins is the latest in a slew of talent to exit from the syndicate.

-

The executive replaces Mike Warwicker, who left the firm earlier this year.

-

Sam Wylie has been appointed portfolio manager.

-

This will allow Ark to write business on surplus line paper and Lloyd’s business.

-

The underwriter joined Catlin in 2006.

-

The underwriter was part of Probitas’ founding team.

-

Both Chubb and Zurich will underwrite the risks, with Nico as the sleeping partner.

-

The facility provides up to $100mn in claims-made excess casualty coverage.

-

The remediation process is on track for completion in the fourth quarter.

-

The CUO described the pricing dynamics in the line as “strong and good”.

-

Co-founder and CUO Jacqui Ferrier has been appointed his successor.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The Kelso and Arch-backed run-off player has retained Evercore to advise.

-

Delaney has spent the last 14 years at TMK.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Chris Jones, Will Shepherd-Barron and David Clark will join the start-up.

-

CEO Rinku Patel said the move marked a “clear step change” in Pine Walk’s MGA strategy.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

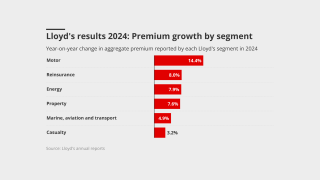

Reinsurance and property remained the primary drivers of premium growth.

-

The Italian carrier posted a record group profit of EUR7.3bn.

-

For the prior-year quarter, the carrier reported a EUR9mn loss.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Genna Biddell will report to Brad Melvin, president and CEO, BMS Re US.

-

Newer swing products offer an alternative way to deal with escalating awards.

-

The underwriter has worked at Axis for a decade.

-

The Pacific region led the quarter’s price decline at -8%.

-

The event now includes a casualty portion and has officially been re-branded as the Property and Casualty Symposium.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Claims related to California wildfires are "fairly insubstantial" to date, executives said.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

Reinsurer appetite largely outweighed demand at 1 January.

-

It is understood that Lectio is now at ~$160mn of premium and could rise to $270mn next year.

-

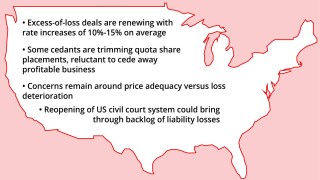

Ceding commissions remain elevated, but primary rates are improving reinsurer margins.

-

Growth vs discipline, smart follow and M&A mean 2025 will be a mixed bag for London.

-

Hannover Re’s CEO said the market had been disciplined.

-

The reinsurer’s large losses tallied up to EUR1.3bn for the nine-month period to 30 September.

-

The broker said the casualty segment is approaching an “inflexion point”.

-

The investor has paid in an extra £12.5mn for an additional 5% holding.

-

Aon executive Daniele de Bosini said reinforced infrastructure had mitigated the impact of recent disaster events.

-

Craig Miller most recently held the role of UK commercial director at Dual Oliva.

-

Sweeney was most recently VP at Vantage Risk, as part of a team responsible for the US financial lines business.

-

The magnitude of the hurricane may impact reinsurers’ capacity deployment.

-

Third-party litigation funding has been linked to rising casualty insurance prices.

-

Reinsurers will likely push for double-digit US premium rate increases.

-

A roundup of the breaking news, C-suite interviews and exclusive insights.

-

The company is currently “underweight” in that line of business, he added.

-

CEO Thierry Léger claims the “insurability” of global risk is becoming “challenged”.

-

The reinsurer constructed a “social inflation index” for a new study.

-

Scor is also limiting its exposure in political risk and cyber.

-

The transaction complements its previous acquisition of RMS in 2021.

-

-

The property market remains “one of the most favourable... I've seen in my career", he said.

-

The mean nuclear verdict for 2013-2022 was $89mn, versus $76mn in 2010-2019.

-

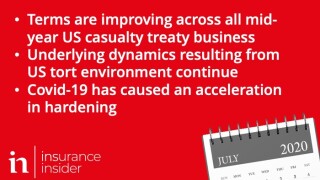

Fears around social inflation have maintained upwards pressure on US liability reinsurance pricing.

-

The broker noted a shift towards alternative risk solutions in the MENA region.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Jessica Cullen is relocating to London from New York to take up the new role.

-

The Lloyd’s chief of markets said he was generally comfortable with market fundamentals.

-

Verdicts awarding more than $100mn hit a new high of 27 last year, study finds.

-

Joy had previously set up the casualty practice at Global Indemnity.

-

Based in New York, the executive will report to global head of casualty Josh Everdell.

-

A minority view gaining currency is that 2016-19 will not be the only problem.

-

The Bermudian’s reserves will be on watch when its Japanese parent reports earnings.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

Property cat and casualty pricing remain steady following chaotic 2023 renewal, with global cat rates rising 3%.

-

As risks continue to become more interconnected, (re)insurers face increased pressure to manage aggregation.

-

Social inflation continues to prove challenging in the casualty space and is rebounding post-Covid.

-

With US third-quarter reporting season being well underway, the results so far highlight further runway for the hard property E&S market.

-

Reinsurers are also determined to secure structural changes and payback from Italian, Slovenian and Turkish cedants at 1 January 2024.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

AI development is creating new risks for insurers to assess as multiple key trends suggest it will evolve into a standalone insurance product like cyber-risk.

-

He joins from Hoerbiger Holding, where he was head of corporate risk and insurance management.

-

The Corporation used its latest market message to call out what it saw as an “underwhelming” approach from specialty insurers to changing conditions and “moronic” D&O underwriting.

-

The French reinsurer said continued price increases, particularly on cat and US casualty, remain necessary.

-

The company’s Monday statement is the latest development in a debacle that could potentially lead to a major loss event for the utility company’s casualty insurers.

-

Dave Cahill and Adam Power have resigned, as Miller managed to shore up remaining members of its casualty team.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

If you only read a handful of articles this week, make it the selection below.

-

Despite reinsurers’ concerns over social inflation and loss trends, capacity remains abundant in both quota share and XoL deals, sources say.

-

The underwriter has worked at various Axa entities for 13 years, holding a string of increasingly senior positions.

-

While panelists agreed that tort reform is needed, they also noted that it couldn’t be achieved by force from the insurance industry alone.

-

DLG’s outlook has been downgraded to ‘negative’ following a 24% tumble in share price since last week, as severe weather and investment-portfolio pressure tank profitability.

-

Inflation will define priorities such as a focus on safeguarding clauses and pricing transparency, as well as line of business challenges, for underwriters and actuaries in the year ahead.

-

The MGA writes management liability, professional indemnity, crime and cyber risk.

-

The new lead underwriter has almost 30 years’ experience including stints at Chubb, Faraday and Howden.

-

The reinsurer added $280mn in casualty pro rata premium in Q4, a 60% jump, while growing casualty XoL writings by 37%, or about $84mn in new premium.

-

The carrier continues to write the class from other global hubs.

-

Kevin O’Donnell also said 1.5-point rises in ceding commissions for long-tail line treaties were an “acceptable” increase in acquisition costs, given improved underlying profitability.

-

The new division is structured into three business units: a chief underwriting office led by Rasmus Nygård, business transformation led by Jörg Hipp and global MidCorp, headed up by Ole Ohlmeyer.

-

The SPA was launched in 2019 and generated a combined ratio of 88.8% last year.

-

Ress will lead Axa XL’s underwriting strategy for general liability, motor and environmental insurance in Europe and the APAC region.

-

Australian insurers are now pursuing a second test case for further clarity on BI policy wording.

-

The newly acquired carrier has confirmed a payout of £80mn for UK Covid-19 claims so far.

-

The carrier will mobilise 3,000 general agents plus distribution partners to make offers on an “unprecedented scale”.

-

The underwriting executive will oversee lines including cyber, D&O and casualty.

-

Reinsurers are clamouring for proportional business, while maintaining excess-of-loss rate rises at 1 January levels.

-

Ascot Group named Matthew Lillegard to its newly created post of group chief actuary on Wednesday, the latest in a flurry of hires.

-

Mathias Neumann was chief underwriter of casualty and specialty at the Japanese company.

-

Insiders Mark Appleton and Thomas Stamm take new roles as the carrier expands management of the line beyond Hanover.

-

The CFO said that commercial lines business was improving faster than retail, reversing previous trends.

-

The hire reflects Ascot’s push to build capabilities on the island.

-

Ben Wallace will lead the team as the syndicate continues to expand in the casualty space.

-

The start-up adds Angus Hampton as head of international casualty and reports a quota-share focus during the renewals.

-

The broker previously held positions at Guy Carpenter, JLT Re and HSBC Insurance Brokers.

-

The insurer is also said to have scaled back its cession percentage to between 25%-30%, with final signings still being determined.

-

Ceding commissions are not falling as reinsurers look to capitalise on insurers' re-underwriting.

-

Brokers are navigating a market where new capacity from underwriters who have waited out the soft market may help dampen price rises.

-

The ruling will follow a final, uncontested court hearing on Wednesday.

-

The insurer was ordered to pay out for policies by the Western Cape High Court earlier this week.

-

The reinsurance CEO says Swiss Re will cut back its US casualty share.

-

Liability account move is latest development in ongoing reinsurance buying overhaul.

-

The Allianz unit says the experience of the Sars epidemic suggests general liability claims are likely to remain benign.

-

Since Covid-19 began to spread in areas with high insurance penetration, the situation has been in constant evolution.

-

The executive’s departure from the Willis Towers Watson merger partner follows that of other casualty reinsurance colleagues.

-

The changes are part of the carrier’s move to a more regional operating model.

-

The transaction covers casualty reserves for the 2009 to 2017 years of account.

-

The deal covers subject premium of around $2bn and will run for 18 months.

-

His anticipated move to Guy Carpenter follows that of Francis Paszylk to TigerRisk.

-

The appointments follow an expansion in the carrier’s European casualty offering earlier in the year.

-

The Accredited program partner has plans to expand into new lines of business.

-

The executive joined the company last year from Swiss Re and has also worked at AIG and Willis.

-

Meanwhile, US GL underwriters fear the impact of Covid-19 litigation.

-

Project is in its early stages, with a round of meetings held to stress test it with PE firms.

-

The insider replaces Detlef Offenhau, who has recently retired from the role.

-

A $49mn marine liability policy held by supply ship operator Rodi Marine is expected to be one of the first in the market to receive a Covid-19-related claim.

-

Insurance lawyers are anticipating a massive surge in PTSD-related claims in the aftermath of the Covid-19 outbreak, amid a wider uptick in liability claims triggered by the pandemic.

-

Insurers for BW Offshore’s Sendje Berge FPSO may have dodged a bullet following a pirate attack on the vessel, but the ordeal may only be beginning for the nine crew members kidnapped in the raid.

-

It will have a maximum line of over $20mn and allow members to adjust lines on a risk-by-risk basis.

-

He replaces Chris Mauduit, who has retired after leading the team for the previous five years.

-

The veteran broker will help diversify the firm’s product offering.

-

The new hire comes amid fierce competition for talent in the broking space.

-

Reinsurers demand exclusions and rate rises in all classes amid pandemic uncertainty.

-

The equity research firm names Beazley as most exposed to the price growth within casualty because of its US hospitals business.

-

Concerns over crew liability claims have led carriers to change wordings and tighten underwriting criteria.

-

At least 20 states in the US have so far moved to limit the liability of care home operators.

-

Aviation and marine experts Dominic Toogood and Gary Moore join the firm from Prospect Insurance Brokers.

-

Florian Beerli, Angela Ives, Jae Park and Alex Marti join the carrier from Chubb.

-

The Chubb CEO calls on Congress to shield corporate America from Covid-19-related litigation as the US begins to re-open.

-

The carrier is looking to grow its business share in the international liability market.

-

The executive was head of casualty for North America and London for Axis Reinsurance.

-

An increase in the severity of securities class actions has seen D&O insurers present a united front against rising litigation, but divisions between carriers remain, writes John Hewitt Jones.

-

Active underwriter says pricing, retro conditions and casualty crisis will play out in MAP 2791’s favour.

-

Carriers are retracting quotes as they balk at taking on further risk amid the Covid-19 pandemic, according to market sources.

-

Remedial actions start to bear fruit in primary property.

-

The analyst predicted that rate hardening will continue, albeit with reduced premium levels.

-

Jonah Pfeffer was previously president of reinsurance at OneBeacon.

-

The book of occupational disease liability is highly volatile and payouts can be significant.

-

Underwriting income for the industry climbed $4.9bn from the previous year, driven by growth in net premiums earned, according to AM Best.

-

His arrival comes as rates surge across the excess casualty market, driven by social inflation in the US.

-

The Japanese-owned carrier installs the fifth and final divisional head following a business overhaul.

-

The liability cover is the second product to stem from the Lloyd’s innovation facility.

-

Global P&C CEO Conoscente offers reassurance on US casualty exposure.

-

The move follows S&P and Fitch putting ProAssurance’s ratings under review.

-

The executive said syndicates would struggle to grow market share as casualty rates rise.

-

The ratings agency said its outlook on the carrier remains unchanged following the announcement of its acquisition of Norcal.

-

Fitch placed ProAssurance ratings on negative watch following the announcement of the acquisition, noting concerns about the medical professional liability space.

-

Colm Lyons, Lee Ackerman, James Perrott and Tom Graham join Syndicate 1969.

-

Analysts remain unconvinced that the US casualty reserving crisis is behind the carrier.

-

The former underwriter left Barbican following the company’s acquisition by Arch.

-

Carriers led by Axa XL are accused of “not acting in good faith” and acting “miserly”.

-

Pre-adverse development cover, the carrier saw impact from directors’ and officers’ and mergers and acquisitions-related business.

-

The CEO explained the reasoning for the carrier's recent reserve increase during a call with analysts on Wednesday.

-

According to sources, AIG underwriters globally have been told not to write new construction risks in Latin America.

-

Berkshire Hathaway-owned MedPro provides medical malpractice insurance in the US.

-

The comments came as Chubb shares rose more than 6.3 percent following the release of fourth quarter results.

-

General liability, professional liability and personal lines were key growth areas for the carrier.

-

The broker has experience placing business for offshore law firms and trust companies.

-

The move by a senior claims executive to the underwriting side comes amid mounting casualty claims due to social inflation.

-

The carrier's first full-year results as a listed entity will include $28mn of unfavourable development.

-

SVP Tom Jurgens told The Insurance Insider that he expects the book to grow at least 15 percent this year.

-

Disruption in P&C markets is expected to boost demand for captive services.

-

If early reporters Travelers and RLI are reliable cross-industry bellwethers, it looks like significantly lower overall catastrophe losses last year will flatter carriers’ Q4 and 2019 results and offset much of the damage from spiralling casualty claims.

-

The appointment follows the closing of Gallagher’s acquisition of Capsicum Re.

-

The former Navigators executive has set up a consultancy called G58 to work with private equity and insurance clients.

-

This publication looks at the 10 most prevalent industry trends for the year ahead.

-

The Australia CEO becomes regional chair and will lead international liability.

-

Since December we have been stressing that the major fourth-quarter results story is likely to be reserve charges taken by carriers that write US casualty books.

-

Sources said carriers will likely need OFAC approval to make liability payments to Iranian families.

-

Reserve calculations are changing as a result of escalating social inflation, the analyst noted.

-

Former Vibe CUO Bradley Knight and casualty colleagues including five class underwriters move from the shuttered Syndicate 5678.

-

The case exemplifies the complications historic opioid claims are causing in the market.

-

The executive will work to develop a new stream of diversified business for the broker.

-

Jeremy Shallow becomes head of international specialty, while Ross MacDonald takes on the post of head of non-US international casualty.

-

The experienced legal and claims executive will underwrite and service a variety of accounts.

-

LMA and Lloyd’s say the exercise will begin around March or April this year.

-

An oil rig off the coast of Norway may seem an unlikely victim of social inflation. But the phenomenon that has created misery for USA Inc and shaped the outcome of the casualty reinsurance renewals is being felt far from the pharmaceuticals companies, the hospitals, the religious institutions – and insurers thereof – perceived to stand well ahead in the firing line.

-

Greenspan was more optimistic about Arch, switching her opinion to ‘overweight’ from ‘equal weight’.

-

Losses in the wider casualty market are affecting relatively loss-free pockets of the energy sector.

-

Broker says alternative capital retracted by 7% as investors exercise caution.

-

Broker’s 1.1 report notes uptick in rates for property cat and non-marine retro.

-

The Insurance Insider looks back to some of the standout pieces of the last 12 months.

-

The Willis Re International chairman says some carriers consider primary rate increases inadequate.