-

The market expects a lower proportion of restoration by utilities than after 2018’s Camp Fire.

-

The storm is expected to bring freezing rain and heavy snow across a wide swath of the US.

-

The reinsurance broker will be known as Marsh Re starting in 2027 as part of a broader company shift.

-

Increased vegetation could spell trouble in the future.

-

Southern is said to have diverted 36 clients with $4mn in annual revenues from Marsh.

-

Philipp Rüede succeeds François de Varenne, who will become senior advisor to the CEO.

-

November hailstorms and current storms and bushfires racked up claims.

-

The event is the second billion-dollar SCS event to hit the country within a month.

-

Defendants can service clients who signed BOR letters as of December 29.

-

Jim Hays outlined $90mn in stock losses as Howden called Brown & Brown’s narrative “false and inflammatory”.

-

Former Aon employees are barred from using Aon’s confidential information.

-

The broker is seeking an injunction, arguing it lost customers to Howden over the weekend.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

BNP Paribas will take a EUR1.11bn stake in Ageas.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

The broker said the A$45-per-share price discussed valued the firm appropriately.

-

The peril has been historically difficult to model compared to others.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run to 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

IAG completed its takeover of RACQ last month.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

This is the first rate filing to use the recently approved Verisk model.

-

The carrier also reported a slightly improved combined ratio of 94.6%.

-

The company also purchased $15mn of SCS parametric coverage.

-

The reinsurance CoR decreased 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

State legislation has led to major strides in rate adequacy.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

The company said the reduction was due to years of steady improvements.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The carrier said the cuts will help it to become a “simpler, digital-led business”.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

The £3.7bn deal was announced in December.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

It previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Tornadoes have killed at least 32 people in three states.

-

Aviva and Direct Line struck the landmark deal in December.

-

Tropical Cyclone Alfred and Queensland flooding brought thousands of claims.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

Insolvencies caused by the tariffs could also cause increased losses

-

The sale price represents Elephant’s approximate net asset value.

-

The executive will define strategic priorities and guide global growth.

-

The business will divide into US wholesale and specialty, and programmes and solutions.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The acquisition will position Ageas as one of the top three UK personal lines insurers.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

The book of business comprises both personal and commercial lines.

-

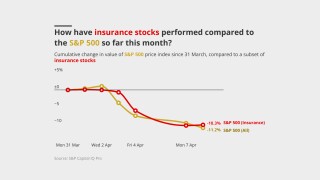

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

The carrier has received 12,300 claims as of 28 March.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The MGA will have a broad casualty-focused appetite with Lloyd’s capacity backing.

-

The carrier said 72% of those losses occurred in personal property.

-

A higher loss quantum will put a greater burden on retro programmes.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

The carrier has been reducing its presence in the state since 2007.

-

The council has begun gathering data to assess the insurance impact.

-

The company’s reinsurance business also has some exposure, the executive said.

-

Keese is also investing in the company alongside its existing partners.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

The carrier is restructuring the business into three segments.

-

The company received over 10,100 home and auto claims as of January 27.

-

Guy Carpenter said personal-lines exposure would account for 85% of the aggregate loss.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

The move comes ahead of a planned sale of Wefox’s insurance business.

-

High-net-worth binders and treaty exposures will bring significant claims to Lloyd’s writers.

-

Investigators are homing in on the likely causes of the incidents.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

He succeeds Wayne Peacock, who retires this year after four years of service.

-

The fast-moving blazes have prompted evacuations across the city.

-

Aviva is targeting £125mn of annual savings within three years of the deal.

-

This follows a preliminary agreement reached earlier this month.

-

High deductibles, tighter underwriting and lack of flood cover meant lower claims figures.

-

The index is a three-year strategic project to track social inflation by analysing personal injury awards.

-

Aviva increases its offer to 275p per Direct Line share.

-

The broker facility is led by Beazley’s Smart Tracker Syndicate.

-

The sale of the business was confirmed in June.

-

The InsurTech is disposing of some non-core business units.

-

Analysts suggested Aviva could sweeten its offer for the UK personal-lines carrier.

-

The insurer will have until Christmas to make a formal offer or withdraw.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

The executive had been interim CEO since January.

-

The letter also called out California insurance companies for investing more than $536bn in the fossil-fuel industry in 2019 alone.

-

Nearly $148mn of the unfavorable reserve development was related to National General, primarily driven by personal auto injury coverages.

-

Stephen Hitch, senior vice president of underwriting at Xchange Benefits, will lead the new MGU.

-

The $500mn of new demand from Allstate highlights carrier need for cover after Ida, but pulling together cat capacity in the peak US market remains a tougher ask.

-

The company’s reinsurance assets rose 7.3% from December 2020 to December 2021.

-

The loss is steering more towards a personal lines event, with loss notifications leading to more optimism amongst reinsurers.

-

The team of around 30 staff will manage the run-off of Axa XL’s existing book and launch a product with Aviva.

-

The modeller said it is “likely” that the number of claims could exceed the high of Hurricane Harvey in 2017.

-

The ratings agency says it will continue to monitor whether the cat event could affect the rating outlook for any entity.

-

State Farm was by far the state’s largest homeowners' writer, writing $1.8bn in premium in 2019, representing 18.3% of the market.

-

In a note to clients seen by this publication, the risk modelling firm says the event may break records for insured winter storm losses.

-

Justice Secretary Robert Buckland says the one-month hold-up is a response to stakeholder lobbying.

-

The deal, pitched at a multiple of 12.2x 2019 earnings, follows disposal agreements for Axa in the Gulf, central and eastern Europe and India.

-

The UK auto insurer expects to return most of the proceeds to shareholders.

-

The GDV trade association reports below-average losses thanks to a quiet winter storm season.

-

The carrier said there were plans to grow the team further and its US and non-US sides would be merged.

-

The Irish broker was founded in 1961 and has around 200 employees writing both commercial and personal insurance.

-

The InsurTech was locked in a dispute with Deutsche Telekom over whether it owns the copyright to the use of magenta.

-

The investor wants the Finnish insurer to build on this week’s sell-down of Nordea Bank shares with further divestments.

-

The carrier raises almost $655mn through the sale of new shares, while existing investors sell another $70mn of stock.

-

The former Ironshore International CEO was most recently chief client officer of Liberty Mutual’s Global Risk Solutions.

-

The New York-based InsurTech launched in Amsterdam earlier this year and made its European debut in Germany last year.

-

Other InsurTechs are likely mulling IPO options and are garnering more investor interest, according to a report.

-

Prices rise in every region for the seventh consecutive quarter, with the UK easily outstripping US growth.

-

Geico’s combined ratio came in at 77.2% down 18 points as frequency fell 24% to 30% across all product lines.

-

CEO Dan Preston says the initiative is part of the company’s strategy to expand into the third-party claims administration sector.

-

Data harnessed from a new litigation tracking product suggests the cruise and care home industry are prime targets.

-

The ratings agency predicts traditional insurance products will be the preferred focus of most start-ups, with some skewing to technology.

-

Sara Steiner joins from RenaissanceRe, where she was most recently vice president of casualty treaty.

-

John Forney succeeds incumbent GeoVera CEO Kevin Nish.

-

Root grew gross written premiums by 85 percent in Q1 to $144mn, according to statutory filings.

-

The mutual insurer is concentrating its physical operations in Ohio, Arizona, New York, Iowa and Texas.

-

US personal auto customers will get a 15 percent credit on their April and May premiums, the company said.

-

A round-up of InsurTech news from 13 March to 20 March.

-

The loss aggregator lifts the tally by EUR10mn from its previous prediction.

-

The transaction reflects the seller's drive to focus on commercial lines and value-added services.

-

Digital Risks, which focuses on the small and medium-sized enterprise market, said it is growing by 25 percent month-on-month.