-

The launch is a milestone in the company’s ongoing US retail buildout.

-

The executive’s departure comes amid a wave of cyber reshuffling in the industry.

-

The MGA is looking to drive its commercial strategy across the globe.

-

The biggest riser in this year’s Allianz Risk Barometer was AI.

-

Global head Bailey said SME demand has seen a “significant increase” since the Jaguar Land Rover attack.

-

Insurance Insider reflects on major loss events of 2025 for the London market.

-

Lyndsey Bauer joined Paragon in 2007 and has previously held senior positions at Marsh.

-

What were the defining moments that shaped the insurance market in 2025?

-

The MGA will also launch into cyber in 2026, adding to its property and marine lines.

-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The data available can “help to inform” a carrier’s strategy in the open market.

-

Plus, the latest people moves and all the top news of the week.

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

The London carrier has explored how businesses are navigating an era of accelerating risk.

-

The argument for buyers to purchase cyber has never been stronger, yet growth is still lagging.

-

The carrier is looking to latch onto emerging economic trends where it can add expertise.

-

The business is pursuing growth in Bermuda in captives, cyber ILS and alternative risks.

-

In mid-morning training, the share price had fallen by 12%.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The carrier plans to invest $500mn in capital to establish a presence in Bermuda.

-

Call for public and private partnership in cyber are not new, but sentiment remains divided.

-

This publication reported in October that Debbie Hobbs was to exit Miller after four years.

-

Cyber claims more than tripled year on year.

-

Specialised service providers like CDK can pose more frequency risk than global operators.

-

The June 2024 ransomware attack produced claims across many firms.

-

Cyber, mortgage and crop were identified as attractive growth areas.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Matthew Hogg joined Liberty Specialty Markets in 2010.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

Christopher Reynolds and AJ Jones have been hired as business development directors.

-

Plus, the latest people moves and all the top news of the week.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Jamie Smith joined Arch in 2018, taking on the senior underwriter role in 2022.

-

Debbie Hobbs joined Miller in 2021 from EmergIn Risk.

-

Michael Shen will be succeeded by deputy Camilla Walker.

-

Manuel Perez will continue in his ongoing role as head of cyber for LatAm.

-

Pryor-White founded Tarian Underwriting, which was sold to Corvus in 2022.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Cyberattack/data breach remains in the top slot.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The deal will be watched closely by Radian’s handful of similar peers.

-

Global pricing is now 22% below the mid-2022 peak.

-

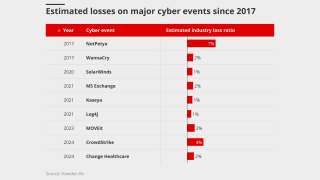

The report highlighted the gap between insured and uninsured attacks is widening.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The MGA is backed by three Lloyd’s syndicates, offering capacity limits of up to $10mn.

-

The relationship between growth and capital is “symbiotic”, the broker said.

-

Being conservative and stable is the name of the reinsurer’s game.

-

Stefan Golling also said Munich Re’s appetite for agg covers was unchanged.

-

It is understood that CyberCube has been considering a sale of the business.

-

Growth in the SME sector could help stabilize the market, however.

-

Cyber reinsurance supply has continued to outstrip demand during 2025.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

-

The company was hit with a data breach on July 16.

-

Emerging lawsuits and expanding loss triggers are giving rise to potential claims under a range of policies.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

Property rates declined by 7% globally in the second quarter.

-

Lucy Fraser has held roles at the ABI, and the City of London Corporation.

-

The MGA no longer has an FCA licence and was wound up in May.

-

Underscoring a more competitive market, the structure includes an escalating premium.

-

BI claims are notoriously difficult to manage and some insurers believe binary coverage can help.

-

Demand and growth opportunities remain ample despite competitive pressures.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

The cyber business will continue to operate as a standalone entity.

-

Carriers expect a rise in the severity and frequency of claims over the next two years.

-

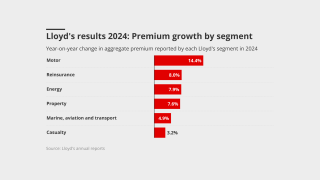

Premium rose across the top 15 P&C risks in 2024.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

There has been an uptick in UK retail firms buying cyber after a string of attacks.

-

Is the ransomware threat really getting worse – or just more visible?

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The facility, backed by six global cyber insurers, offers limits of as much as EUR5mn.

-

The firm believes UK support for policyholders is under-served compared with the US.

-

Plus, the latest people moves and all the top news of the week.

-

The carrier’s president Andrew McMellin is aiming to double London market share in the next five years.

-

The Beazley CUO said geopolitics would determine cyber market pricing.

-

Coverage has broadened while limits have increased, the broker said.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The executive was formerly the head of cyber solutions, North America.

-

The carrier has scaled up its international insurance offering in recent years.

-

The protection gap is calling into question the relevance of the insurance industry.

-

The new Lloyd’s chief of market performance also outlined target growth areas.

-

Eric Seyfried and Glen Manjos are also departing Axis’ cyber and tech unit.

-

Plus, the latest people moves and all the top news of the week.

-

What’s next for Conduit Re’s strategy following a leadership shake-up?

-

Plus, the latest people moves and all the top news of the week.

-

While M&S had a cyber policy in place, Co-op and Harrods did not, Insurance Insider revealed.

-

M&S, which still faces disruption from the attacks, had coverage lead by Allianz.

-

The hire is the latest in the newly formed carrier’s buildout.

-

Plus the latest people moves and all the top news of the week.

-

-

Soft conditions have led to “less acute" underwriting discipline, sources said.

-

The Willis-brokered coverage also includes the Willis CyXS facility.

-

Ransomware threat actors are continuing to attempt ‘smash and grab’ attacks.

-

Sentiment at the ILS Connect event hosted by Insurance Insider ILS was generally positive.

-

Joanne Barry will be joining the team at Zurich.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The underwriter is taking on a role with Cipriani and Werner.

-

The only major product line to see rate increases was casualty.

-

Alongside Chatterjee, SVP Dharma-Wardana has also exited the team.

-

It is understood that Marsh brokered the tower, which is exposed to claims from a 2024 breach.

-

Despite a softening market, carriers still have belief in their profitability, sources said.

-

The Gallagher Re executive called on the market to “prepare to grow sustainably together”.

-

The facility now includes CyXS Plus and CyXS Company.

-

James Barrett has been interim head of cyber since October 2024.

-

Sources said extending coverage to Gen AI may be difficult and unnecessary.

-

The combined ratio improved by 3.2 points, from 80.9% in 2023 to 77.7% in 2024.

-

Ethan Godlieb will be leading cyber, tech and fintech for the broker.

-

Reinsurance and property remained the primary drivers of premium growth.

-

Cyber, marine and aviation are recent areas of focus.

-

The broker has launched a company market section of the facility called Encore.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The product provides primary and excess coverage limits up to £5mn.

-

Predicting underwriting conditions for the remainder of the year is ‘challenging’.

-

The London carrier posted an undiscounted combined ratio of 79%, up from 74% in 2023.

-

The MGA’s US clients will now have access to London market capacity.

-

This year's modelled outputs have increased across all return periods.

-

The CMC will categorise cyber events that have a potential financial impact of £100mn+.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

Jason Hart, head of proactive cyber, was also promoted to managing director.

-

-

Panellists discussed the softening market, and what would flip the switch on rates.

-

In its latest report, the carrier cites the top 10 cyber incidents of 2024.

-

The biggest riser in this year’s Allianz Risk Barometer was climate change.

-

Supply generally exceeded demand and trading relationships were ‘strong’, CEO Tom Wakefield said.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

The underwriter will report to group CUO Paul Bantick.

-

The former CEO will also serve as executive managing director within Aon’s reinsurance solutions business.

-

Tillett succeeds Michela Moro who is returning to Italy, according to Allianz.

-

Cyber is more in the one- or two-year loss development camp, the Lloyd’s CUO said.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Sources agreed that to achieve growth, the focus is shifting from the US to SMEs in Europe.

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

Envelop Underwriting will bring all the firm’s underwriting into one framework.

-

D&O and D&F are also facing increased competition, but property remains price adequate.

-

Their new guide sets out the factors (re)insurers should consider when defining a major cyber event.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The exit follows that of Guy Carpenter’s head of cyber centre of excellence for international, Siobhan O’Brien.

-

The cyber solution is backed by Mosaic, Chubb and Liberty Specialty Markets.

-

The Hartford will assume a quota share of Coalition’s UK cyber program.

-

Overall, insurance rates fell by 1%, led by competition in property.

-

Areas with growing demand and complexity include natural catastrophe and cyber, it said.

-

The new proposition will offer £10mn primary cover and £15mn limit for XoL.

-

A canvassing of the market showed some bifurcation on the necessity of a government backstop.

-

It also reported that severity increased by 17% in the same period.

-

Geopolitical conflict could expose the global economy to $14.5tn in losses.

-

Matt Foster joins Coalition following an eight-year tenure at Munich Re.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

Glyn Thoms will be stepping into a newly formed role with a focus on cyber strategy formulation and management.

-

Envelop Risk Solutions will provide technical assistance and advisory services.

-

Sources said that for reinsurers to meet this demand, they will need to get comfortable analysing and evaluating systemic and aggregate risk.

-

Improved profitability has led some insurers to increase their own retentions.

-

Coalition Re to offer active cyber reinsurance via two products supported by Aspen-led capacity.

-

A whitepaper published by the two companies set out measures that could create cyber insurance capacity.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

The July downtime will increase relevance, demand and innovation for the market.

-

Lancashire was the only carrier to see double-digit growth in insurance revenue for H1.

-

The CEO said he expects cyber rates to start flattening post-loss.

-

A canvass of sources suggests that a $3bn-$5bn loss could tip the cyber market into unprofitable territory.

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

What is the purpose of the Underwriting Room in the post-Covid working world? According to Lloyd's Market Association CEO Sheila Cameron, the Room remains the "beating heart" of the London insurance ecosystem, and there is "overwhelming support" to maintain it. In her role at the LMA, Sheila has a unique insight into what is top of the agenda for all 55 managing agents. Tune in to the podcast to get the latest on Blueprint Two, the state of regulation, and leadership diversity.

-

Securities class actions are a perennial source of claims for D&O insurers.

-

In messaging to the market, the cyber insurer described the rating environment as “stable and sustainable”.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The investment will be used to scale operations and extend its presence in key international markets.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The market is expected to seek additional exclusions around systemic events.

-

The cyber market should use the latest outage to start decisively taking action on managing cat aggregates.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

The carrier’s cyber hours clauses and sub-limits will limit exposure, according to the analyst.

-

Market sources suggest that this will be a manageable loss, although at this early stage there are multiple uncertainties.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

Insured losses in the single-digit billions would not translate into a material impact for (re)insurers.

-

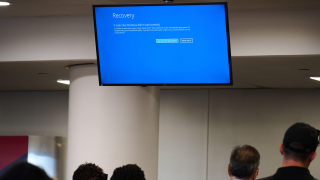

The airlines, healthcare and financial services industries were some of the sectors affected by the outage.

-

The broker warned that D&O and P&C policies could also be impacted by the outage.

-

CrowdStrike has an estimated 15%-25% market share among large companies.

-

The incident highlights the aggregation risk around cloud service reliance.

-

Listen in as Aegis London CEO Alex Powell discusses how to underwrite profitably through the cycle, the carrier’s growth in the cyber market, and the company’s future strategy.

-

-

Many have argued war exclusions have detracted from discussions of systemic risk in the cyber market.

-

The business specialises in hard-to-place risks.

-

Lucien Mounier has served for six years as Beazley’s head of Asia Pacific

-

Improved cyber hygiene and strong insurer competition has driven rate reductions.

-

Quota share commissions are under pressure amid changing buying patterns.

-

The ratings agency said improvements in cyber hygiene, underwriting and policy language were contributing factors.

-

The multiline MGA was co-founded by Lea's fellow Vantage alum Farhan Shah.

-

Vanessa Maxwell will remain global head of financial lines.

-

The global nature of cyber means a UK ransomware pay license would have "no material impact" locally.

-

The MGA has added Scor and Argenta’s syndicates to its panel.

-

Cyber insurance rates for UK clients dropped 12% on average, Marsh said.

-

The Incyde Risk facility will provide up to $25mn in capacity on a primary and first-excess basis.

-

The updated framework from the Corporation provides less “scope creep”, said CUO Rachel Turk.

-

Since 1 January, the market’s potential descent into freefall has been closely watched.

-

Parametric triggers are likely to involve financial losses and a number of impacted businesses.

-

Cyber physical damage cover has also been added to the facility.

-

The goal is to narrow the cyber protection gap, strengthening UK resilience.

-

James Platt has previously held group COO and chief digital officer roles at Aon.

-

The consortium will offer up to $50mn of per-program capacity.

-

Global commercial insurance rates rose 1% in Q1, down from a 2% increase in Q4 2023.

-

The broker used a consensus-based hypothetical cat event type to analyse its global impact.

-

The Lloyd's CUO warned against "calling victory too early".

-

The carrier's UK portfolio will no longer be written with an in-house team.

-

The cyber market faces significant claim notifications from Change Healthcare clients.

-

Cyber Quoting will connect global cyber insurers and US distributors.

-

The average rate increase in the cyber market stands at 1.6%.

-

CyberCube expects ransomware attack to impact both large and SME accounts.

-

Stefan Sperlich will lead the new division as managing director.

-

However, it doesn't prove a mutual is a wrong concept for the cyber market.

-

Leahy has worked in the London market for almost a decade.

-

The project is not immediately moving forward due to lack of client demand.

-

Brit Cyber First50 will be placed through the Brit-led consortium.

-

Small scale cyber attacks are set to increase in the near term.

-

The deal adds to Aspen’s existing support of the InsurTech in the UK and Canada.

-

Many carriers’ views on cyber are mixed, the agency said.

-

Dejung spent 13 years at Scor, most recently as cyber CUO.

-

-

The facility is backed by a host of Lloyd’s syndicates.

-

Shannan Fort was a partner in McGill’s FI and cyber team.

-

The code has been launched by the Code of Conduct Claims Working Group.

-

Anderson first joined Scor in 2017 as a senior cyber and technology underwriter.

-

Envelop SPA 1925 was launched at the start of the year with Chris Baddeley as active underwriter, based in London.

-

The timeline for the centre launch was announced at last year's CFC Cyber Forum, in which CFC's then CUO described the launch as a “coming of age for the cyber market”.

-

The 1 January renewals featured a significant shift away from mainstay quota share and aggregate coverage, with examples including Axis and Brit dropping specific stop-loss covers.

-

Political violence rose up the agenda, with conflict raging globally, and key elections due this year.

-

The uptake on war exclusions, which was followed by other reinsurers, could signal the end of "endless" discussions on the topic.

-

Insurance competition remains vibrant in some of the segments that remain most exposed to persistent risks highlighted by the flagship World Economic Forum report.

-

Prior to his resignation, Stubbs held the role of deputy class underwriter at Chaucer Group.

-

-

Traditional InsurTech offerings for the UK mid-market "often fall short", according to Cowbell UK’s Simon Hughes.

-

The 11th hour settlement came just days before the case was scheduled to be heard by the New Jersey Supreme Court.

-

Salvatore Sama has been named global product head for casualty, while Jane Farren has been named global head of financial professional lines.

-

Gareth Wharton announced his exit after nearly 18 years with the company in a post on LinkedIn.

-

Howden was the most active acquirer as people-move activity peaked in Q2, this publication’s data showed.

-

Gamze Konyar has been promoted from her prior role as head of Marsh’s cyber practice for the Central and Eastern Europe and Eastern Mediterranean regions.

-

Getty was appointed to the role in December of last year, having joined Talbot as cyber and technology class underwriter in 2017.

-

Aidan Flynn said that although different markets are expected to move at different speeds, the underlying trend is clear.

-

The product is led by Canopius and IQUW, with support from three other Lloyd’s insurance company markets.

-

The incoming cyber head was previously head of cyber for Marsh Europe.

-

Edward Hart joined Aspen in February and has previously held roles at Brit and Barbican.

-

Patrick Bousfield is understood to have resigned from his current role as senior broker at Lockton Re Bermuda.

-

At a point when cyber rates are falling and capacity is plentiful in high excess layers, the mutual plans have the wider cyber market somewhat perplexed.

-

He joins the cyber specialist from Aspen where he held the role of international head of cyber since 2019.

-

Clearer wordings for cyber cat risk would also help foster the development of the more capital-efficient event XoL reinsurance market in cyber, Kessler said.

-

The Bermudian also revealed a $29mn restructuring charge for Q3.

-

Reports show that the combined use of supply chain exploitation and data exfiltration is causing double-digit million-dollar losses for cyber insurers.

-

Pierro will be responsible for establishing operations in France and growing the company’s European cyber insurance portfolio.

-

Current cyber brokerage leader for the US and Canada, Meredith Schnur, will succeed Reagan as cyber practice leader, US and Canada.

-

With new leadership at some of the largest continentals, there will be close attention to how their tactics in changing lines of business will evolve.

-

Podmore joins from Swiss Re, where he held the role of lead cyber underwriter.

-

Executives said geopolitical uncertainty, economic stagnation, cyber, cat events and inflation will drive demand on the Continent.

-

The International Underwriting Association has urged cyber insurers, brokers and clients to focus on risk management to help better respond to claims.

-

Jose Carlos Jiménez Fernández and Rafael Ortiz Losada have joined the company as senior underwriters.

-

The US could be exposed to economic losses of $1.1tn in the event of a cyberattack, the highest of any country.

-

Two studies have found that, while almost a third of back-up attempts fail to restore system data after a ransomware attack, cybercriminals are refining their methods.

-

The fine relates to a breach that took place in 2017, where hackers were able to access the data of 13.8 million UK consumers.

-

Former Tokio Marine Kiln cyber underwriter Alex Jomaa is CUO for the firm and head of UK.

-

Plus this week’s people moves and all the top news from this week.

-

The centre will identify, define and categorise cyberattacks in a similar way to catastrophe events.

-

The report also stated that digital technology could generate savings of 10%- 20% in other processes in the value chain.

-

A report from the firm warns that the market needs to upskill on cyber.

-

AI development is creating new risks for insurers to assess as multiple key trends suggest it will evolve into a standalone insurance product like cyber-risk.

-

The company’s Las Vegas casinos were hit by a cyberattack last month where employee login details were stolen.

-

The MGA has promoted Rehan Hussain to head of underwriting for international and Tom Ryan to head of cyber for UK, Ireland and the Nordics to guide the expansion

-

Insurance Insider has analysed premium growth trends across Lloyd's and the company market for 2022.

-

Head of underwriting Matthew Waller welcomed an FCA letter that called for policy wordings that are clear and that customers understand the coverage they are buying.

-

Bianconi joined Aspen in 2016 and has held a number of roles including, most recently, as head of US cyber.

-

The 2023 Travelers Risk Index has put concern over cyber threats among the top three worries for small, medium-sized and large businesses for the ninth straight year.

-

Lloyd's chief of markets Patrick Tiernan said the Corporation is comfortable that a cyber risk pre-mortem exercise showed the market could cope with a major cyber incident.