-

Guy Carp has been rebuilding its marine and energy team after a major Willis Re team lift.

-

The carrier has also promoted Jamie Pedro to head of specialty re, Bermuda.

-

Plus, the latest people moves and all the top news of the week.

-

It is understood the marine reinsurance programme renewed largely flat.

-

Talbot’s former hull head Vicky Hayward has joined Rubicon Specialty to launch a hull account.

-

Price has become a key differentiator in marine and energy.

-

Luca Ronsisvalle and Jan von Kamp bring marine and energy capability.

-

Plus, the latest people moves and all the top news of the week.

-

-

Nearly one-third of 2025’s talent movement was recorded in Q3.

-

Plus, the latest people moves and all the top news of the week.

-

The marine insurer said a volatile claims environment necessitated rate adjustments.

-

The business recently struck a deal to be acquired by Aquiline.

-

The Lloyd’s-backed war-on-land facility provides coverage where capacity remains scarce.

-

The carrier plans to invest $500mn in capital to establish a presence in Bermuda.

-

Simon Mason will continue to support the business through the upcoming reinsurance renewals.

-

The business was founded last year by former Beazley underwriter Richard Young.

-

Emma Woolley has held the marine role on an interim basis alongside running Talbot.

-

Stephenson will start his new role in early 2026.

-

Volt was launched in October 2024 to support clients through the energy transition.

-

Willis Re kicked off its talent acquisition with mass hiring from Guy Carpenter over the summer.

-

Beazley is one of the key leaders in the London marine marketplace.

-

The traditionally lucrative class has faced a series of challenges in the latest geopolitical crisis.

-

The hire follows the departure of David Martin to GIC Re Syndicate.

-

The two lines will add £11mn in planned premium.

-

The CEO said that IGI’s action within its PI book showed it was ready to walk away from unprofitable business.

-

Ark has been adding new product lines across its three Lloyd’s syndicates.

-

The 2024-25 period has been the worst on record for claims, with costs of $775mn+.

-

The recent Iumi conference highlighted the impact of waning globalisation and tariffs.

-

Property remains the dominant line, accounting for nearly 30% of total London premiums.

-

The executive joins from MSIG USA.

-

Plaintiffs allege that manufacturers and retailers have broken environmental laws.

-

The Howden MGA established its marine presence in the Netherlands in 2023.

-

New capacity continues to flow into the hull market, despite rating pressure.

-

The aviation market may prove an outlier following a disastrous year of loss activity.

-

The Argenta-backed MGA is already active in the cargo and property classes of business.

-

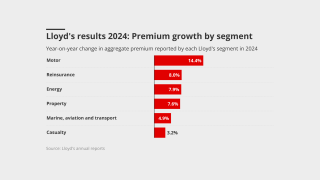

Lloyd’s reported reinsurance GWP increased 10.6% to £13.2mn.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

Donna Swillman is currently a senior underwriter at Axa XL.

-

The broker is in hiring mode in specialty after numerous brokers departed for Willis Re.

-

The broker said it was achievable to place a $2bn vertical limit in the London market.

-

He succeeds Felix Cassau, who is joining Hannover Re.

-

A notable uptick in attendance underpins the value still placed on the iconic trading centre.

-

Assurex’s global independent broker network pumps $4bn of premium into the London market.

-

The insurer has substantially expanded its marine team in recent years.

-

Rachel Sabbarton has been promoted to CEO at Lancashire Syndicates.

-

The underwriter left Navium Marine last year and before that worked at Atrium.

-

The move will impact around $50mn of gross written premiums in total.

-

The broker said that there could be a flattening of rate decreases in the hull market in 2026.

-

Arch will continue to provide long-term capacity for the MGA.

-

The Canadian insurer saw property rates dip across its global divisions.

-

Staff targeted include producers that channel business through Howden’s London wholesale arm.

-

Group CEO Tavaziva Madzinga said it might explore Lloyd’s Names backing in the future.

-

Sources said MarshBerry is advising the underwriter.

-

The carrier has also hired Imogen Wright as underwriter marine and energy treaty.

-

The executive has spent 13 years in the broker’s marine division.

-

Syndicate 1947 is gearing up to expand its marine reinsurance portfolio.

-

The Cathal Carr-led carrier has been building its team since launching this year.

-

The unit will include both ocean and inland marine coverage.

-

The aerospace, energy and marine markets all sustained multiple significant losses in H1.

-

Plus, the latest people moves and all the top news of the week.

-

It has been a volatile week for the marine war market in a period of geopolitical turmoil.

-

Plus, the latest people moves and all the top news of the week.

-

There has been significant talent displacement in the specialty reinsurance market.

-

The carrier is launching a dedicated auto-follow unit within its DA practice.

-

Western insurers do not insure Iranian risks, with the country subject to sanctions.

-

Some segments are moving faster than anticipated, but overall, it remains a mixed bag.

-

The carrier has scaled up its international insurance offering in recent years.

-

The London market is not expected to shoulder the bulk of the eventual loss.

-

The purchase aims to bolster Markel’s marine product line in the Asia-Pacific region and EU.

-

TMGX is designed to help insure the green transition.

-

Politically related exposures are growing for the marine market.

-

New capacity is fuelling competition for talent in the class of business.

-

Cincinnati Global entered the cargo market this year.

-

TMK formed its specialty reinsurance unit last year.

-

The underwriter has held positions at The Hanover, Liberty Mutual and Zurich.

-

The broker replaces Louise Nevill, who is joining Axa XL as CUO for specialty.

-

Competition is high in specialty reinsurance as new capacity enters the market.

-

Insurance Insider revealed earlier this week that the underwriter had resigned from Allianz.

-

New capacity continues to enter the hull market, and rates are falling.

-

The final month of the year saw an unusually high number of claims.

-

The business is looking to grow its marine offering across its global platform.

-

Jonathan Mesagaes will report to John Hyland, head of underwriting and marine.

-

Simon Horton spent 10 years at Marsh before joining AIG last year.

-

Fierce competition for cargo talent continues in the London market.

-

Anthony Grew joins SiriusPoint after four years with Allied World.

-

The broker will be based in Oslo and drive expansion in the Nordic region.

-

Meco's 2024 gross written premiums totaled $63mn.

-

The Applied Underwriters unit has been building out its product base in the London market.

-

The InsurTech was part of the fourth cohort at Lloyd’s lab.

-

Current specie head Victoria Bell is leaving Argenta to join Axis.

-

The coverholder’s deal with SiriusPoint expired at 1.4.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

The product offering is led by Rob Earrey and James Harris.

-

The MGA will operate as an appointed representative of Davies.

-

Conflict between China and Taiwan would be a “game changer” for marine war.

-

The carrier has moved to hire in the fine art and specie line after the exit of Mark Benbow.

-

Reinsurance and property remained the primary drivers of premium growth.

-

The underwriter will be based in New York and drive underwriting strategy.

-

Gard acquired Codan’s global marine and energy portfolio during 2024.

-

Cyber, marine and aviation are recent areas of focus.

-

The hire is part of a wider expansion across Willis’s specialty business.

-

The property and specialty insurer reported underwriting profits of $131mn ($170mn).

-

The Corporation said pricing within aviation was “almost certainly inadequate”.

-

A collision earlier today caused a cargo of jet fuel to burst into flames.

-

Nevill has extensive experience in underwriting at Talbot, WR Berkley and Markel.

-

Competition for specialty reinsurance talent remains high.

-

Plus, the latest people moves and all the top news of the week.

-

Camilla Gower joined TMHCCI in 2020 from StarStone.

-

The underwriter will relocate to the London market from Genoa.

-

The promotion comes as the cargo market faces talent turmoil.

-

Plus, the latest people moves and all the top news of the week.

-

The marine market has experienced another flurry of personnel movement.

-

The departures come after long-serving MD Andrew Hills left the business last year.

-

An increase in tonnage from new and existing members drove up income.

-

The MGA launched last October with a B.P. Marsh investment.

-

Westfield Specialty has experienced high turnover in its London market operations.

-

Plus, the latest people moves and all the top news of the week.

-

Social inflation and larger vessels are making multi-billion losses more likely.

-

Westfield’s international expansion saw it buy Syndicate 1200 from Argo for $125mn.

-

The broker has made several recent hires within its marine division.

-

The carrier unveiled its launch last week and is hiring across its divisions.

-

Contour Underwriting is a specialty lines MGA.

-

Iumi expressed concern about the escalation of trade wars.

-

New entrants have contributed to competition in the class of business.

-

New entrants in the cargo space have caused another round of talent displacement.

-

The business wrote the deal through its recently established Lloyd’s syndicate.

-

Loss assessment is at an early stage, but senior sources suggested the claim could surpass $1bn.

-

The company said the proliferation of new MGAs was “great news” for brokers and clients.

-

The appointment comes after the departure of Mark Benbow, who is joining Westfield.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

Aon is in hiring mode following the departure of several senior brokers to Howden Re.

-

The Swiss insurer will continue to write the class of business from its French office.

-

The move marks a return to underwriting for Michelle Boyd, who worked at Axa XL and HDI.

-

As 2024 draws to a close, we reflect on the events of the year for the London market.

-

Churn is expected to return to the market in 2025 as scrapping of older fleet accelerates.

-

The IG said this year had been “more difficult” for the group’s reinsurance partners.

-

David Hughes has a line size of A$10mn with a global mandate.

-

The underwriter worked for Markel for a decade.

-

The Aventum Group broker launched a cargo and stock throughput division earlier this year.

-

Alexander Schlei will succeed Carsten Schulte in his former role.

-

The underwriter most recently worked as head of hull and war for Travelers Syndicate 5000.

-

Hannah Brooke joins the UK and Ireland team from HDI’s Belgium business.

-

The cargo market has recently seen a string of moves as new carriers launch into the market.

-

Marine and energy were the busiest lines, driven by high competition for talent.

-

Guy Pierpoint will report to head of marine Phil Wheeler.

-

A spree of new entrants in the cargo market has resulted in recent talent turmoil.

-

The Pen Underwriting MGA is expanding from its marine war specialism.

-

The specialty reinsurance space has experienced a recent period of talent churn.

-

Amwins is working to build out its London underwriting business.

-

The carrier can write marine on company and Lloyd’s platforms after the Probitas deal.

-

The marine MGA is continuing to build out its staff base and product offering.

-

Staff movement in the class of business is high as new carriers launch into the space.

-

Davide Pressman was a marine cargo underwriter at Aegis for under two years.

-

Several businesses are set to launch new marine offerings in 2025.

-

Under his leadership SiriusPoint has established partnerships with several marine MGAs.

-

The long-serving Aon broker specialises in the placement of cruise portfolios and Norwegian accounts.

-

This follows Ascot hiring Charlotte Brotherton-Farrell.

-

The storm caused major damage to one of the drinks company’s warehouses in Tennessee.

-

The broker said that pricing dynamics would require careful management, but adequacy remains

-

Chris Terry is joining from Apollo to run the cargo book, and TMK’s Louis Robertson will build the specie account.

-

The loss of premium income from Glencore is expected to add to competitive pressures running up to 1 January.

-

It will be the 16th consecutive year Gard has offered an owners’ general discount.

-

He will work for the Spectrum Risk Management business, which was acquired by Nexus.

-

The Goldman Sachs-backed broker will buy out BP Marsh’s stake.

-

Achieving profitability is increasingly challenging in the volatile but historically lucrative market.

-

The launch will add to a marine portfolio which already includes cargo and reinsurance accounts.

-

The marine underwriter said the business had grown through taking “very big positions” on programmes.

-

How do you build a $400mn MGA? Navium Marine CEO Clive Washbourn told Behind the Headlines that his business is a "fighter jet" out hunting for deals. Navium has built scale by taking on risk "in a fairly aggressive way" with large line sizes available to deploy. Whilst the marine market is now coming under pressure, Washbourn still thinks there is "robustness" in rating, although making money in the volatile Red Sea war market is challenging.

-

The loss of the major account has been a substantial hit to budgets for some carriers.

-

The syndicate will continue to diversify its portfolio but growth will be “more conservative” in 2025.

-

Syndicate 318 has been expanding into specialty classes over the past few years.

-

The IG’s $3.1bn reinsurance tower is facing double-digit pricing increases in the wake of the Baltimore bridge disaster.

-

Underwriters are broadly pricing on the basis of a $1.5bn Baltimore claim, but there is uncertainty.

-

The underwriting executive will support Axis through the 1 January reinsurance renewals.

-

The new product adds to its existing portfolio of upstream energy and marine and energy liability business.

-

The broker will join the marine liability team within the new Ken Syndicate 3832.

-

Setting aside the storm’s greater potential insured loss scale, the flood risk implies greater exposure.

-

The hull market is currently experiencing high levels of competition.

-

The vehicle provides coverage for non-physical damage BI.

-

The company will write marine cargo and transport logistics policies across the country.

-

The marine market is challenged by global warfare, supply chain breakdown and the complicated energy transition.

-

The Jan De Nul-owned Zheng He was seized by Mexican authorities in November last year.

-

US lawmakers are looking to introduce legislation backdating to before the bridge collapse incident.

-

There has been an exodus of hull premium from the London market to Nordic carriers since 2014.

-

The marine carrier’s financial result for the period was $25mn.

-

The appointment is the latest in a string of hires in the broker’s marine operation.

-

Despite potential claims stretching into the billions, the events are not expected to shift the dial on pricing.

-

The business is formed out of the existing Thomas Miller Specialty Offshore team.

-

The change comes as negotiations start to kick off for 2025 renewals.

-

Negligence must be proved to cover any loss of life for passengers under P&I cover.

-

The facility launch comes after Marsh launched its Slipstream marine facility.

-

He joins the firm following the departure of Edward Morgan and Guy Tyler, who have launched an MGA.

-

Hales will switch to underwriting after a career specialising in marine claims.

-

Current head of marine hull Helen Costin is set to retire from the business.

-

The carrier is expanding its MGA partnerships and has invested in its marine team.

-

The broker said rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

Navium has scaled rapidly to become one of the largest marine insurers in the market.

-

This publication has reported several exits from the carrier’s Lloyd’s operation.

-

Loss assessment is ongoing but the event looks likely to be a total loss.

-

Although talent movement in Q1 2024 was above Q1 2023 levels, personnel movement slowed in Q2 2024.

-

Plus the latest people moves and all the top news of the week.

-

The launch comes after the broker established a marine division earlier this year.

-

Re-marketing of large fleets can result in double-digit rate decreases as carriers chase income.