-

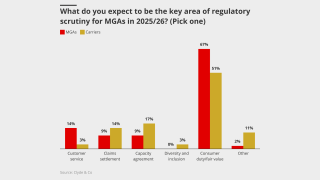

A key area of focus for the watchdog this year is delegated authority.

-

The trade body called for a new Financial Services Bill early in 2026.

-

The broker has analysed the differences in wildfire risk between Northern and Southern California.

-

The company will manage Octave-backed syndicates 4242 and 1416.

-

Most Covid BI claims are due to lapse in March 2026.

-

Howard Hughes Holdings agreed to buy the carrier for $2.1bn.

-

As demand rises across the digital asset space for multiple forms of crypto-related insurance, competition is building.

-

The guidance will come into force on 1 September 2026.

-

The LMA, FCA and Liiba welcomed the direction of travel but said progress is slow.

-

The review found an unrelated breach over the CEO failing to log a journey on a private jet.

-

The reinsurer is offering pricing incentives to members to reintegrate cover.

-

Call for public and private partnership in cyber are not new, but sentiment remains divided.

-

Sheila Cameron called on Lloyd’s to “accelerate” its commitment to behavioural change.

-

Whether Rebekah Clement's promotion was influenced by an inappropriate relationship is in scope.

-

Apollo CEO David Ibeson was also in the running for a seat on Council.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

Liès called for the industry to have a louder voice to promote greater insurance literacy across sectors.

-

The sector’s recent achievements have flown below the radar, despite huge value creation.

-

An insurability crisis could pose systemic risks that undermine the foundations of finance.

-

Regulators do too little to distinguish between generalists and specialists, he said.

-

How do struggling governments across the globe tackle stagnating economic growth?

-

The financial services growth strategy could be “turbo-charged” by involving brokers, it said.

-

Differentiating Lloyd’s claims performance could help drive business to the market.

-

The report seeks to arm parliamentarians and policymakers with “practical tools”.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Without flexible mechanisms the Corporation risks suppressing transactions.

-

The protection gap must be closed before a public cyber reinsurance scheme is possible.

-

Susan Langley will look to strengthen global business ties and promote UK growth.

-

The executive has been with ASG since it was formed in 2016.

-

The Corporation’s chair laid out plans to make Lloyd’s a preeminent market in the long term.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The assistant treasurer is also due to review the Australian cyclone pool.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

Lloyd’s will keep heritage systems operationally resilient until at least 2030.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

This is the first rate filing to use the recently approved Verisk model.

-

Market leaders Atradius and Coface have both received in-principle approvals for a Lloyd’s syndicate.

-

The carrier cited elevated cat and large-loss activity, including the LA wildfires.

-

The LMA head also praised Velonetic for transparency on Blueprint 2.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

Sources have identified facilities as a different source of rising commissions.

-

The UK carrier will write business that falls in the scope of the FSCS.

-

The reduced fine reflected the PRA view that the breaches weren’t deliberate.

-

Surveys show diversity and inclusivity foster a sense of belonging and increase productivity.

-

Questions remain over regulatory touch, capital requirements and tax benefits

-

The suit claims billions of dollars are being illegally withheld.

-

Airmic has been lobbying the government to introduce a captives framework for years.

-

The strategy is a 10-year plan to drive growth in UK financial services.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

The government is consulting on reforms to the existing regulations.

-

The outcome of the consultation includes a detailed timetable for delivery.

-

State legislation has led to major strides in rate adequacy.

-

The trade body sent an open letter to the UK Chancellor ahead of her Mansion House speech.

-

Claims chiefs are caught between technological advancement and waiting for phase two

-

Cultural transformation, education, and leadership are also essential to creating safe workplaces.

-

The PRA, FCA and Society of Lloyd’s have agreed to the changes.

-

The challenge now is balancing top-line growth with underwriting discipline amid falling rates.

-

The new chair said the market must adapt for 2030 and beyond.

-

The FCA is reviewing how it can simplify regulation for commercial insurers.

-

The measure could have landed insurers with extra tax on US business.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

Green hushing is on the rise as Trump rows back on climate initiatives.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The event was co-hosted by The Fidelis Partnership and IDA Ireland.

-

The £3.7bn deal was announced in December.

-

CEO Caroline Wagstaff called for a “tailored and proportionate” approach to regulation.

-

The association said privacy should be a key consideration in new requirements.

-

The LMA urges use of AI for enhanced decision making but concerns remain.

-

Future claims handlers could be "bionic adjusters” empowered by technology.

-

The increased tariff on China trade could drive up the loss quantum on the SharkNinja recall and others.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

The change reflects the company’s growing profile within the MS&AD group.

-

The majority of the savings are expected to be realised in the retail division.

-

The Lord Mayor told the CRO Summit to stop treating risk as a dirty word.

-

The CEO transition is already visible in messaging on growth as rate change picks up.

-

Delegates welcomed the FCA’s red-tape cut, but said more is yet to come.

-

Lloyd’s CUO said established broker facilities were “big enough”.

-

The platform could help reduce claims-cash holding times by 10 weeks.

-

The CUO noted that market-wide rate change in Q1 was down 3.3%, coming in below plan.

-

The consultation is a “welcome change of approach” from the regulator.

-

Aviva and Direct Line struck the landmark deal in December.

-

Plans include a new definition of commercial customers and lead insurers compliance only.

-

The group said corporations face geopolitical and climate risk.

-

Pushing through technological change and maintaining underwriting results are top of agenda.

-

The proposals consist of supervisory expectations rather than rules.

-

Full Vanguard testing is expected to compete by the end of the year.

-

Risk managers at last week’s Axco summit said interconnected global risks require flexibility.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

Insolvencies caused by the tariffs could also cause increased losses

-

Representatives from the UK broker have been ordered to appear before magistrates on 7 May.

-

Sources expect it to be a couple billion-dollar insurable market.

-

From where to prioritise investing to managing slower growth, there are tough balancing acts ahead.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

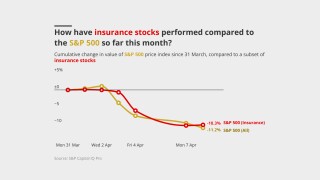

European reinsurers, London market carriers and composites all enjoyed healthy trading.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Swiss Re and Talanx led the gains among listed European carriers.

-

What does the bustling insurance industry of today have in common with the coffee shops of the seventeenth century?

-

CEO responsibilities will be shared by Chris Newman and Tanya Krochta.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The regulator is also aiming to digitise and simplify its authorisation process.

-

CUO Rachel Turk said some syndicates were showing a “mismatch” in ambition and strategy.